[vc_row][vc_column][vc_column_text css=”.vc_custom_1572368477713{margin-bottom: 0px !important;}”]

The fund, Nova Appian Preferred Income Fund I, is targeting $50m for the niche strategy.

By Peter Benson

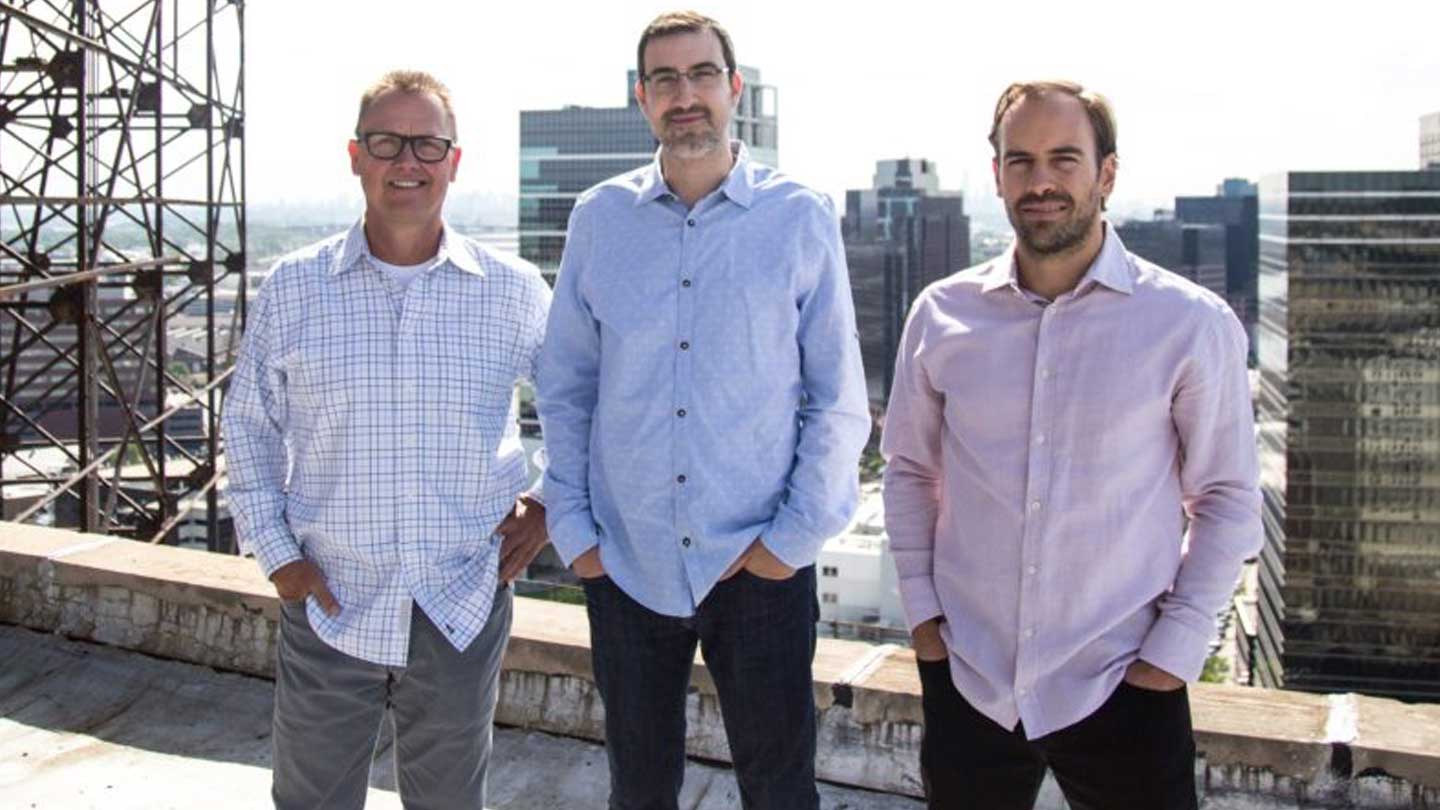

OneWall Partners, a Newark, NJ-based real estate private equity firm focused on workforce housing, has launched its first fund, a preferred equity vehicle targeting workforce housing adjacent to gateway northeastern US markets. “Preferred equity provides a margin of safety for investors and the workforce housing asset class has been resilient and stable during various economic cycles,” said Nate Kline, partner and chief investment officer at OneWall.

The fund, Nova Appian Preferred Income Fund I, is targeting $50m for the niche strategy. OneWall, since its launch in 2010, has typically raised capital on a deal-by-deal basis from over 100 retail investors, family offices and institutions.

The firm started buying small properties in northern New Jersey that had good access to the employment markets of New York City and Philadelphia to try to prove out the model. Almost a decade later, the firm owns over 3.5 million square feet worth close to $530m. That track record combined with the launch of the vehicle helps expedite the scaling of the operation. “Having the fund gives us a better opportunity to expand that investor base,” said Kline.

It also helps OneWall move faster in the marketplace. Kline explained that on previous deals with institutions, it took longer for the investor to carry out due diligence, slowing the deal process down. With a fund that changes. “There’s not a looming deadline for them to participate,” said Kline. “Committed capital behind us makes us much more competitive in the marketplace.”

The case for the strategy

A big reason the strategy works for OneWall is the necessity for good workforce housing close to employment bases the firm is targeting. “It’s very expensive to buy and own a home in New England in places convenient to major employment centers,” said Kline. “There’s a massive supply demand imbalance between what people want and people can afford to live in.

So as that market dynamic has taken hold, the places the average workforce member can afford to live have been pushed further away from the center of the employment center. “Millions and millions of people t that demographic,” said Kline.

OneWall seeks properties that have lower rent than the new Class A supply that has sprung up in major cities due to it being the only residential property type that works on a development play because of skewed market economics. When those properties start springing up further out, the firm looks to buy properties nearby, knowing that they will benet. “[Development adjacent properties] provide a nice higher ceiling for rent growth,” said Kline. “The properties generate a nice yield but maintain rents for the population.”

The firm targets properties close to medical, education and government jobs, diversifying the employment base while also protecting against any recession. “EMG are the most durable and consistent job providers,” said Kline. “We don’t see nurses getting laid o in a recession.”

Ultimately, it’s the search for a good quality of life that OneWall are looking to facilitate and capitalize on. “People want a lifestyle community that enables them to walk into downtown,” said Kline. The smaller towns or suburbs of the big northeastern employment centers offer that at a more reasonable price than in the city itself usually.

Going forward

As the firm has scaled, its presence has grown in northern New Jersey, as well as the Lehigh Valley and further west in Philadelphia. Its presence also increased around Albany, for the government employment, and Long Island out of a necessity for good housing. “Long Island has the most acute imbalance between supply and demand,” said Kline. “It’s incredibly difficult to develop new product out there.”

Connecticut has started to appeal to the firm and some of the fund is likely to be invested in the Fairfield and New Haven counties if the right deals surface. Depending on how the fund goes, further afield from the firm’s home base could also be in play. “We’d like to eventually get into the DC and Boston suburbs,” said Kline. “It could be possible to get into one or both of those markets at the later stages of this fund.”

(click on the following link for the complete article)

https://refi.global/[/vc_column_text][/vc_column][/vc_row]