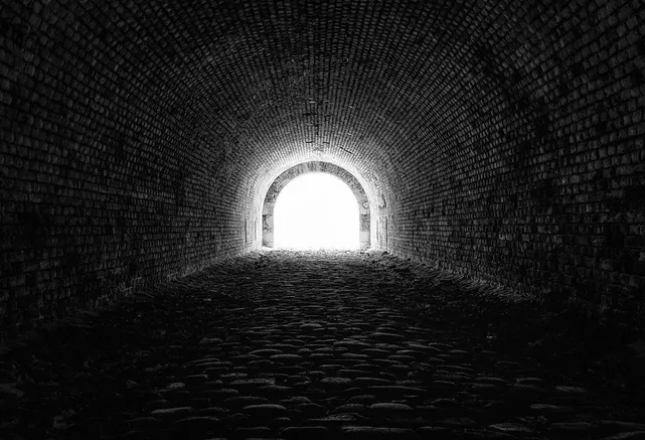

You’re Probably Going To Lose Money In 2023. But There’s Light At The End Of The Tunnel

3 January 2023 Mike Phillips, Bisnow London

If 2022 was the year a genuine downturn finally came to commercial real estate after a bull run of more than a decade, then what of 2023?

To be the bearer of bad news, CRE in ’23 is likely to bring subdued liquidity, price falls and not a small amount of distress, as increased debt costs continue biting and economic growth slows around the world.

But — and it’s still only a small but — it could also be the year interest rates peak and investors gain enough confidence to start making new investments in a sector that has shown resilience compared to the last major financial downturn, cementing its place in the hearts of institutions across the world.

“We’re seeing price adjustments, but we’re not going to rush in to invest during a volatile period in the market,” Ivanhoé Cambridge head of Europe and Asia-Pacific Karim Habra told Bisnow. “We have strong convictions on markets supported by structural trends. So with that respect, we are a long-term investor and we’re not necessarily looking to buy at the very bottom.”

A big slug of data points to 2023 following the pattern of the second half of 2022 and being a thoroughly difficult year for commercial property in the U.S. and UK. Individual assets and buildings could prove exceptions, but being in commercial real estate will be a lossmaking endeavour this year, on average.

Oxford Economics forecasts U.S. commercial property will produce an average total return of -2.2% in 2023, while the UK will see a total return of -3%, with falling values wiping out gains from the income property produces. In 2022, U.S. real estate saw a return of 4.2% versus -2.2% for the UK.

In the U.S., retail and hotel property will be the only major sectors seeing positive returns of 1.8% and 1.2%, respectively. Residential property in both countries will see returns of -5%.

In terms of price drops, MSCI‘s latest U.S. Capital Trends report highlights the price of shares in listed property companies in the U.S. and UK having fallen significantly even as the price of real estate in the private market has not. Shares in listed U.S. residential companies fell 29% in the first three quarters of 2022, for example, while assets in the private market rose 8% in the same period.

Where shares in property companies go, asset prices usually follow, it said.

MSCI’s analysis compares the average difference between the price being asked by sellers of U.S. offices and the average price being offered by buyers. It found a bid-ask spread of about 12%, meaning prices have to fall by that amount for the market to start to unlock, though actual prices could fall more or less than that amount.

Analysts at Green Street said the 25% fall in the price of U.S.-listed real estate companies implied a drop of about 20% in the value of property assets. It said its U.S. index was already 13% below its peak, suggesting there is 7%-8% still to go.

“Next year’s news on property prices will be ugly, as slow-to-react appraisers have barely begun to notice a downturn,” the firm wrote in November. “In reality, prices are already down by a double-digit amount and further declines are more likely than not.”

A lack of liquidity in the real estate market, created by the sharp rise in rates across the world, is likely to endure in 2023.

For investors that use debt, the cost of borrowing is above the average yield in sectors like residential, industrial and office in both the U.S. and UK. That means more is paid out for interest on a loan than comes in on rent, keeping investors like private equity firms and private companies on the sidelines.

Many investors that don’t have debt have a problem, too.

“What we’re seeing in real estate globally is the impact of the denominator effect,” said Louise Kavanagh, Nuveen chief investment officer and head of Asia Pacific Real Estate.

Because the value of institutional investors’ stocks and bonds has fallen faster than the value of their real estate, property now makes up a bigger proportion of their entire portfolios. That could mean they have to sell assets to bring allocations to the sector in line with targets, or at least not make new investments, a sharp reversal of the last decade.

Data from Hodes Weill found that overall, institutional investors want to increase their allocation to real estate in the long term. But in the immediate term, about a third are now overallocated to the sector, compared to just 9% last year.

“They’ve seen the value of other asset classes shrinking, meaning they’re holding off investing in real estate, at least until they’ve worked out what’s going on with the current volatility,” Kavanagh said

“It is very, very difficult to raise new money for equity funds right now,” LaSalle Investment Management Chief Executive of Global Partner Solutions Jon Zehner said, again referencing the denominator effect. “The time to raise money is before the downturn comes, rather than trying to persuade people of the opportunities when things are already difficult.”

For those that have already raised that money, “yes, there is dry powder out there, but there isn’t the debt to make it accretive,” Zehner said. “I don’t think lenders will come rushing back to the market next year.”

As for the oft-vaunted opportunities that might arise from distressed sellers, open-ended funds needing to raise liquidity to repay redemptions have been the main source of sales at discounted prices so far, not sales driven by lenders. MSCI said just 0.6% of sales could be counted as distressed in the third quarter of 2022, 10 quarters after the start of the pandemic. In Q1 2010, 10 quarters after the start of the financial crisis, distressed sales rose to 19%.

In one sense that is a good thing for real estate — distressed sales don’t imply a healthy market. But it means a price signal for investors to begin coming back into the market has yet to emerge. Will that happen in 2023?

“With credit much more expensive in the current market than in the previous two years, investments completed in the period of easy credit may not work as well,” MSCI said.

Nuveen’s Kavanagh pointed to the development sector as the one to watch in terms of distress, with development loans needing to be refinanced and construction costs having risen in the past two years.

While 2023 is likely to be another difficult one, it could also see the start of the turnaround in real estate’s fortunes. All eyes will be on inflation around the world and the subsequent actions of central banks.

“You should see interest rates peak in the first quarter, and either plateau or start to gradually come down from there,” Bei Capital founder Collin Lau said. “As interest rates start to normalise, that will bring investors back to the market. And unlike in 2009, there is not as much stress in the banking market.”

Increases in Asian stock markets at the end of 2022 caused institutions overallocated to real estate to start looking at new deals again, Lau said.

“You’re likely to see an asynchronous decoupling in central bank policy and in real estate markets,” said Sabina Reeves, CBRE Investment Management chief economist and head of Insights & Intelligence. “Europe will be first in and first out of a recession. Normally, it lags the U.S. and UK, but an energy price shock pushed it into recession. It will be sluggish growth, but hopefully by the end of Q1 interest rates will have peaked, and they will start coming down again by the end of the year.

“We’ve already started to see price discovery in Europe and the UK — discounts have been asked for and received. It’s primarily the debt buyers who are out of the market, but you can still transact.”

For the U.S., things might take a little longer, Reeves said. The strong U.S. labour market is likely to mean the Federal Reserve has to raise rates higher than its European equivalents in order to tame inflation. The Bank of England forecasts interest rates peaking at between 3.75% and 4.5% around the middle of the year, she said, compared to a peak expectation in the U.S. of 5.1%, with rates not starting to fall until 2024.

MSCI said U.S. investors are still betting on interest rate falls in the near to medium term. In the third quarter of 2022, 62% of new commercial mortgages taken out were floating rate; in Q3 2020, 58% were fixed rate. If rates do fall over the life of the mortgage, that will free up cash and make deals more profitable.

Yet rates rising higher for longer means the U.S. market is likely to remain subdued for longer than European counterparts, although the UK is also dealing with the dual effects of high energy prices and a Brexit-induced slowdown.

Despite the threat of an impending recession, Reeves said one thing in real estate’s favour is that it’s not facing a general oversupply problem at the moment, meaning rents should not fall too far even if economies contract.

There is an oversupply of grade-B office space in major markets, and retail will face headwinds from reduced consumer spending, which will also take some of the wind out of the sails of e-commerce.

“But this is primarily a capital markets phenomenon,” Reeves said.

Looking past 2023, predictions call for returns to rebound strongly. Oxford Economics forecasts a total return for UK real estate of 9.5% and 9.1% for the U.S. in 2024. In both countries, it predicted industrial will be the top performing sector.

Globally, with savings rates among citizens high and economic growth expected to be higher than in Europe and North America, Asia could take a bigger share of the investment pie in 2023.

“We expect to significantly expand in Asia-Pacific, we have big ambitions in this market,” Ivanhoé Cambridge’s Habra said. “It is less affected by energy issues and economies there are generally strong, the fundamentals are there for long-term growth.”

“A lot of global investors are still underallocated to the region, so we continue to see a lot of appetite for investment here,” Nuveen’s Kavanagh added.

The possibility of a crisis in China’s overleveraged residential property market remains a concern for investors, she added. But economic growth of 4.5% still looks attractive when other regions are contracting and investors are not yet seriously concerned the country’s economic wobble could contaminate the entire region.

When it comes to sectors, this recession doesn’t seem likely to change anyone’s mind about where the strongest growth is in the medium to long term. It is just changing the price at which people are buying into their preferred assets.

“Our convictions haven’t changed, it is still logistics, residential sectors like co-living or student housing, other alternative asset classes, and assets like offices that are strong on ESG,” Habra said. “If your assets aren’t sustainable, they will be much less liquid in the future.”

CBRE IM’s Reeves said the firm’s three big bets going forward remain logistics, residential, and next generation life sciences facilities and offices aimed at the tech sector. Accessing those sectors through debt might get better returns next year, however, she added.

This economic climate might have changed investors minds in another way, though.

“I think real estate has proven itself pretty resilient resilient relative to fixed income, which has suffered in this riot of super high inflation and rising interest rates,” Bei Capital’s Lau said.

Investors buying corporate bonds have seen the value of their investment fall far faster and further than those that invested in real estate.

“Investors will remember that, and real estate will continue to benefit,” Lau said.