But Affordability Improves From Previous Quarter in 58 Percent of Local Housing Markets; Wage Growth Outpacing Home Price Growth in 22 Percent of Markets, Including San Diego, Brooklyn, Seattle, San Jose and Manhattan

IRVINE, Calif. – Dec. 20, 2018 — ATTOM Data Solutions, curator of the nation’s premier property database, today released its Q4 2018 U.S. Home Affordability Report, which shows that the U.S. median home price in the fourth quarter was at the least affordable level since Q3 2008 — a more than 10-year low.

The report calculates an affordability index based on percentage of income needed to buy a median-priced home relative to historic averages, with an index above 100 indicating median home prices are more affordable than the historic average, and an index below 100 indicating median home prices are less affordable than the historic average. (See full methodology below.)

Nationwide, the Q4 2018 home affordability index of 91 was down from an index of 94 in the previous quarter and an index of 106 in Q4 2017 to the lowest level since Q3 2008, when the index was 87.

Among 469 U.S. counties analyzed in the report, 357 (76 percent) posted a Q4 2018 affordability index below 100, meaning homes were less affordable than the long-term affordability averages for the county. That was down from a 10-year high of 78 percent of counties posting an affordability index below 100 in Q3 2018.

“While poor home affordability continues to cloud the U.S. housing market, there are silver linings in the local data as home price appreciation falls more in line with wage growth,” said Daren Blomquist, senior vice president at ATTOM Data Solutions. “Affordability improved from the previous quarter in more than half of all local markets, and one in five local markets saw annual wage growth outpace annual home price appreciation, including high-priced areas such as San Diego, Brooklyn and Seattle.”

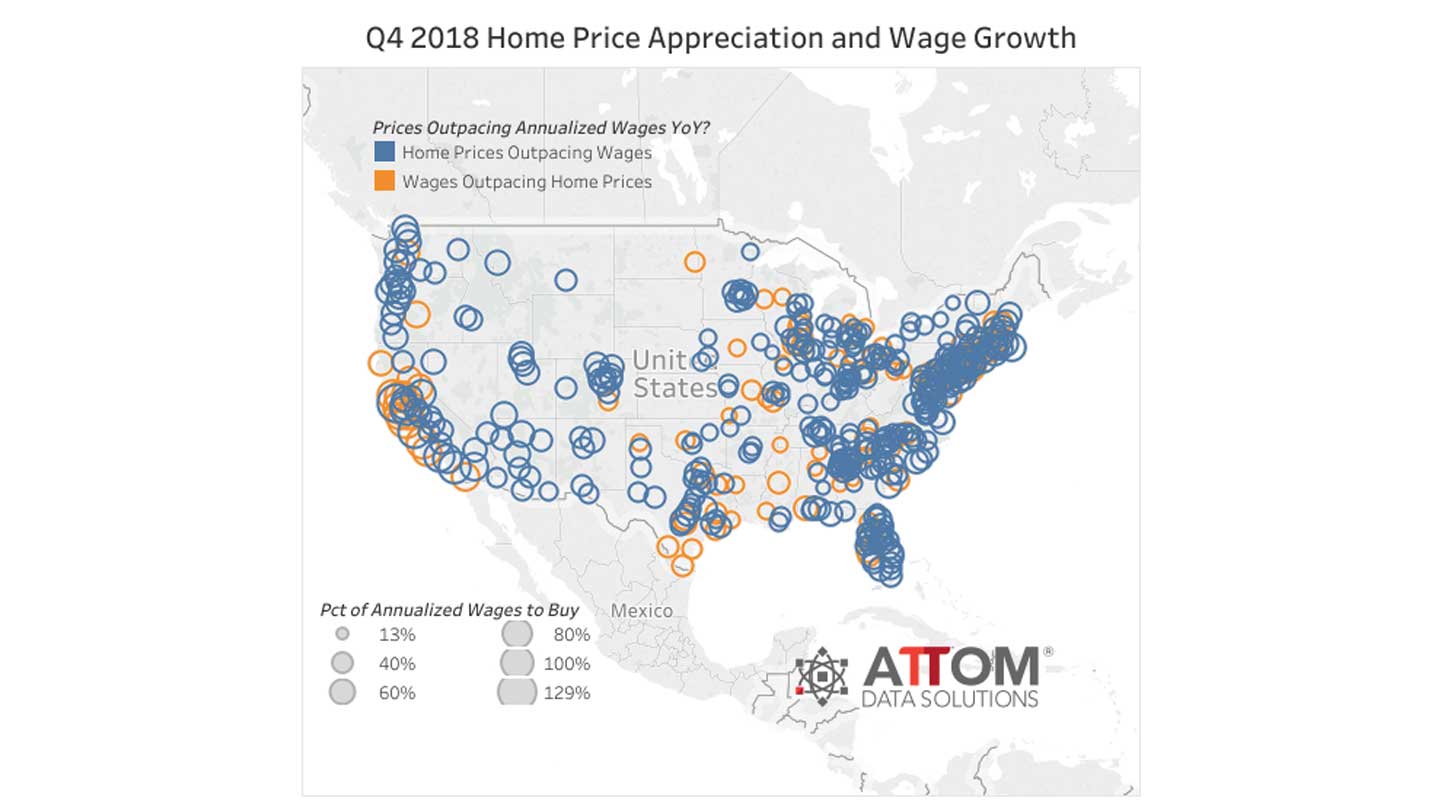

Q4 2018 Home Price Appreciation & Wage Growth Heat Map

Home affordability improves from previous quarter in 58 percent of local markets

Counter to the national trend, home affordability improved from the previous quarter in 272 of the 469 counties analyzed in the report (58 percent), including Cook County (Chicago), Illinois; Harris County (Houston), Texas; San Diego County, California; Orange County, California; and Miami-Dade County, Florida.

Home affordability worsened compared to the previous quarter in 197 of the 469 counties analyzed in the report (42 percent), including Los Angeles County, California; Maricopa County (Phoenix), Arizona; Riverside County, California; San Bernardino County, California; and Clark County (Las Vegas), Nevada.

Wages rising faster than home prices in 22 percent of markets

Nationwide the median home sales price in Q4 2018 was $241,250, up 9 percent from a year ago, while the annualized average weekly wage of $56,381 was up 3 percent from a year ago.

Annual home price appreciation in Q4 2018 outpaced annual average wage growth in 366 of the 469 counties analyzed in the report (78 percent), including Los Angeles County, California; Cook County (Chicago), Illinois; Harris County (Houston), Texas; Maricopa County (Phoenix), Arizona; and Orange County, California.

Counter to the national trend, annual average wage growth outpaced annual home price appreciation in 103 of the 469 counties analyzed in the report (22 percent), including San Diego County, California; Kings County (Brooklyn), New York; King County (Seattle), Washington; Santa Clara County (San Jose), California; and New York County (Manhattan), New York.

Highest share of income needed to buy a home in Brooklyn and Bay Area

Nationwide, buying a median-priced home in Q4 2018 would require 35.0 percent of an average wage earner’s income, above the historical average of 32.0 percent.

Counties with the highest share of wages needed to buy a median priced home in Q4 2018 were Kings County (Brooklyn), New York (128.8 percent); Marin County, California (124.1 percent); Santa Cruz County, California (118.2 percent); Monterey County, California (96.9 percent); and San Luis Obispo County, California (94.4 percent).

Counties with the lowest share of wages needed to buy a median-priced home in Q4 2018 were Baltimore City, Maryland (13.1 percent); Bibb County (Macon), Georgia (13.5 percent); Clayton County, Georgia (15.5 percent); Peoria County, Illinois (15.7 percent); and Wayne County (Detroit), Michigan (15.9 percent).

Buying a home requires income of $100,000 or more in 15 percent of local markets

Buying a median-priced home required more than $100,000 in annual income (assuming 3 percent down and a maximum front-end debt-to-income ratio of 28 percent) in 70 of the 469 counties analyzed in the report, led by New York County (Manhattan), New York ($408,977 to buy); San Francisco County, California ($375,491 to buy); San Mateo County, California ($368,242 to buy); Marin County, California ($315,524 to buy); and Santa Clara County (San Jose), California ($308,178 to buy.

Report Methodology

The ATTOM Data Solutions U.S. Home Affordability Index analyzes median home prices derived from publicly recorded sales deed data collected by ATTOM Data Solutions and average wage data from the U.S. Bureau of Labor Statistics in 469 U.S. counties with a combined population of more than 220 million. The affordability index is based on the percentage of average wages needed to make monthly house payments on a median-priced home with a 30-year fixed rate mortgage and a 3 percent down payment, including property taxes, home insurance and mortgage insurance. Average 30-year fixed interest rates from the Freddie Mac Primary Mortgage Market Survey were used to calculate the monthly house payments.

The report determined affordability for average wage earners by calculating the amount of income needed to make monthly house payments — including mortgage, property taxes and insurance — on a median-priced home, assuming a 3 percent down payment and a 28 percent maximum “front-end” debt-to-income ratio. For instance, the nationwide median home price of $241,250 in the fourth quarter of 2018 would require an annual gross income of $70,384 for a buyer putting 3 percent down and not exceeding the recommended “front-end” debt-to-income ratio of 28 percent — meaning the buyer would not be spending more than 28 percent of his or her income on the house payment, including mortgage, property taxes and insurance. That required income is higher than the $56,381 annual income earned by an average wage earner based on the most recent average weekly wage data available from the Bureau of Labor Statistics, making a median-priced home nationwide not affordable for an average wage earner.

About ATTOM Data Solutions

ATTOM Data Solutions provides premium property data to power products that improve transparency, innovation, efficiency and disruption in a data-driven economy. ATTOM multi-sources property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood data for more than 155 million U.S. residential and commercial properties covering 99 percent of the nation’s population. A rigorous data management process involving more than 20 steps validates, standardizes and enhances the data collected by ATTOM, assigning each property record with a persistent, unique ID — the ATTOM ID. The 9TB ATTOM Data Warehouse fuels innovation in many industries including mortgage, real estate, insurance, marketing, government and more through flexible data delivery solutions that include bulk file licenses, APIs, market trends, marketing lists, match & append and more.

(click on the following link for the complete article)